In January 2020, Thailand confirmed the world’s first case of coronavirus outside of China. It is found that their earliest cases of coronavirus came from the people who arrived overseas. For this reason, the country immediately enforced a tight lockdown and emergency measures.

By January 23, Thailand raised its travel advisory to level 3 which means all non-essential travels from high risk countries will not be allowed. And by April, borders had been closed and they banned almost all of the incoming flights. The island of Phuket has also been placed under lockdown, entertainment venues were temporarily closed, all schools and colleges were canceled for two weeks, and screening measures were implemented at all hospitals. These were just among Thailand’s earliest steps to contain the spread of coronavirus.

According to the Global Security Index, Thailand is Asia’s most prepared country to face a global pandemic and ranked sixth out of 165 countries.

From pandemic success to economic contraction

No matter how prepared a country is, this fast-evolving pandemic has largely affected every nation’s economy globally. As a tourism-dependent country, Thailand’s incoming 3-4 million international tourists per month dropped to near-zero back in April. Their national workforce average monthly income declined by 47% and 60% of hospitality businesses could close by the end of the year.

Amid this financially struggling situation, the expenses to get treatment for COVID-19 alone is a scare to many people. Now the question is, how much should a person prepare in case he experiences a mild, severe, or critical case of coronavirus?

The hefty cost of COVID-19 treatment

In general, it is expensive to get sick. But in the middle of a pandemic, it becomes much more financially straining because the medical costs are rising substantially. Therefore, getting treated with COVID-19 comes at a heavy price.

Depending on the severity of cases, the hospitalization and treatment for a coronavirus patient cost at an average of $30,000. This may include hospital expenses for the patient’s set of doctors with different specializations, intubation, laboratory tests, ventilator, respirator, and medication. It also varies from where the patient will get admitted. The treatment in private hospitals is relatively more expensive than government-owned hospitals and facilities.

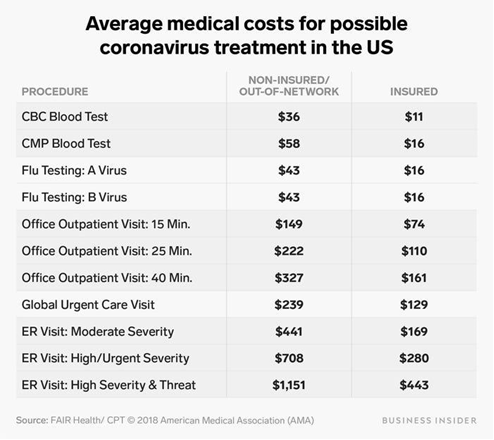

Below is a chart that shows the possible coronavirus-related medical costs for each patient:

Our Expat client who was diagnosed with COVID-19 in Phuket, Thailand

Phuket is Thailand’s largest island and has been home to 115,000 expatriates from around the world. One of those is our client — a French national who was, unfortunately, a confirmed case of COVID-19.

Last March, he contracted the virus which cannot be treated through home quarantine. He was then admitted to Bangkok Phuket Hospital to undergo the necessary treatments. When he got discharged, his total medical expenses amounted to over THB 250,000 or approximately USD 8,000.

Our client survived this challenging time without having out-of-pocket expenses related to his COVID-19 treatment. Since 2017, he has been an EasyCare+ Plan holder which protected his savings even at the time of a pandemic.

COVID-19 coverage wherever you are around the world

The COVID-19 crisis affects people’s financial stability and most of all, their overall well–being. As an international healthcare provider, our goal is to provide our clients with continuous access to quality healthcare no matter where they are around the world and whenever they need it. Even more during this time of a global pandemic, their health is our utmost priority.

A+ International Health Plans covers COVID-19 treatment so long as you are in good health at the time of registration and with no pre-existing conditions. For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally. Each of our health plans is tailored to your specific needs. You can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

Health insurance is getting a lot of attention these days. With the rising cost of medical treatment, people have been purchasing healthcare plans for themselves and their families. It is a major investment to make because they can be of financial help in case of an emergency.

When getting a health insurance plan, a few things can affect one’s premiums — some are uncontrollable while others can be changed through lifestyle choices. The following are the top factors that companies consider when pricing out their policies:

1. AGE

Health insurance premiums vary per age. Whether getting a short-term or long-term policy, age plays the biggest role in how much medical support a policyholder will get. While medical exams have been getting stricter nowadays, age also determines if a person qualifies for health insurance coverage in the first place.

How much will your premium be? The younger you are, the lower the premium. This is because young people have lower chances of visiting the doctor and facing health issues. On the contrary, the older you are, the higher your premium will be. Elderly insured individuals may require more medical support due to developing chronic conditions.

2. BODY MASS INDEX (BMI)

Body Mass Index or BMI calculates your body fat based on your height and weight. Paying good attention to your BMI is a starting point to assess your health condition. If BMI is higher than normal, it can help you determine if you are at risk for some serious illnesses, like type 2 diabetes, heart-related problems, and some types of cancer.

When a person is underweight or overweight, he might need to prepare a little extra when shopping for medical insurance plans. The quote can even be twice as high for people with obesity. That is why having a healthy BMI will help you enjoy standard insurance rates because you have higher chances of living longer.

3. PRE-EXISTING MEDICAL CONDITIONS

A pre-existing condition can either be a medical illness, usually chronic or long-term, or injury before the start date of your new health plan coverage. The question is, can health insurance companies reject your application when you have a pre-existing condition?

Depending on the insurer’s General Condition and government regulation, the insurer may or may not accept your plan application. They can accept you into the plan, but they have the choice whether to cover your pre-existing condition or put your pre-existing condition in the exclusion list, although some conditions can be covered after completing certain waiting period Therefore, if the insurer cannot cover it, the policyholder will need to shoulder all the costs related to his pre-existing condition.

4. FAMILY MEDICAL HISTORY

Aside from your state of health, health insurance companies would also want to know your family’s medical history. When you are genetically susceptible to certain diseases such as cancer and heart problems, there is a chance that your insurance premium will go up. But in most cases, it does not happen.

Medical insurance companies generally ask this to have a better understanding of your overall health. This will also determine the eligibility and pricing of your policy. Having a clean record on family’s health background should not worry a person who is applying for medical insurance.

5. SMOKING OR TOBACCO USE

According to the Centers and Disease Control Prevention, smoking is the leading preventable cause of death in the United States — causing 480,000 deaths each year. Smoking increases health risks and impacts the cost of your medical coverage.

Generally, health insurance companies charge high premiums to smokers, tobacco users, and people who have used tobacco for the last 12 months. This is because they are considered high-risk insurance buyers as compared to non-smokers. In the worst-case scenario, a person who smokes 2-4 cigarette packets a day may be rejected for a medical insurance plan.

6. PROFESSION OR OCCUPATION

Your job has major implications for your medical insurance policy. A job that is considered high-risk has higher premiums because it jeopardizes the insured individual’s life. Sometimes, a person with risky activities can be disqualified for coverage at all. Some jobs with hazardous duties are miners, deep divers, firefighters, airline pilots, and those working in high-rise construction.

Why is a higher premium charged for certain occupations? A restaurant manager who does not travel for his job has low-risk factors as opposed to a cruise line worker who may experience dangerous sea-related calamities. Accident-related risks increase a person’s probability of facing critical injuries or earlier-than-normal death, therefore, you have to pay more.

7. LOCATION OF STAY

Healthcare costs differ in every country or state. So when purchasing for medical insurance, where you live could affect your policy. Certain geographical locations have high premium rates due to a lack of healthy food options, shared climate, and health issues.

In the marketplace, there are numerous affordable options where you can choose a local or international healthcare plan. With international plans, you do not have to worry about moving to a different country because you have the freedom to choose which area you would like to be covered.

International Healthcare That Is Tailored to Your Specific Needs

When shopping for a healthcare plan, anyone is looking for the best value. Knowing these factors can affect your policy, it is now much easier to assess how much cost you would need to shell out for your protection. That is why it is important to research about the medical insurance company or simply talk to an insurance broker to sort out which plan works out best for you and your budget.

If you are looking for affordable yet comprehensive international healthcare, EasyCare+ International Health Plans gives you world-class protection wherever you are. Each plan is tailored for your specific needs. For as low as $28/month, you can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>