In January 2020, Thailand confirmed the world’s first case of coronavirus outside of China. It is found that their earliest cases of coronavirus came from the people who arrived overseas. For this reason, the country immediately enforced a tight lockdown and emergency measures.

By January 23, Thailand raised its travel advisory to level 3 which means all non-essential travels from high risk countries will not be allowed. And by April, borders had been closed and they banned almost all of the incoming flights. The island of Phuket has also been placed under lockdown, entertainment venues were temporarily closed, all schools and colleges were canceled for two weeks, and screening measures were implemented at all hospitals. These were just among Thailand’s earliest steps to contain the spread of coronavirus.

According to the Global Security Index, Thailand is Asia’s most prepared country to face a global pandemic and ranked sixth out of 165 countries.

From pandemic success to economic contraction

No matter how prepared a country is, this fast-evolving pandemic has largely affected every nation’s economy globally. As a tourism-dependent country, Thailand’s incoming 3-4 million international tourists per month dropped to near-zero back in April. Their national workforce average monthly income declined by 47% and 60% of hospitality businesses could close by the end of the year.

Amid this financially struggling situation, the expenses to get treatment for COVID-19 alone is a scare to many people. Now the question is, how much should a person prepare in case he experiences a mild, severe, or critical case of coronavirus?

The hefty cost of COVID-19 treatment

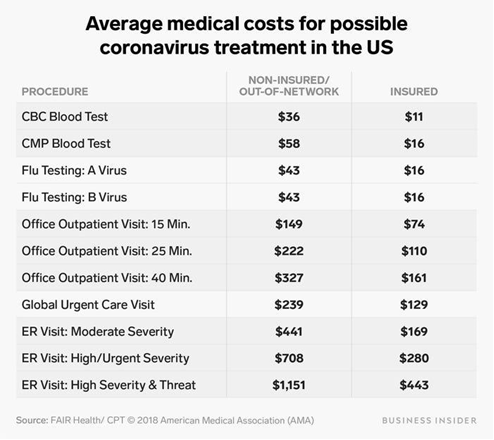

In general, it is expensive to get sick. But in the middle of a pandemic, it becomes much more financially straining because the medical costs are rising substantially. Therefore, getting treated with COVID-19 comes at a heavy price.

Depending on the severity of cases, the hospitalization and treatment for a coronavirus patient cost at an average of $30,000. This may include hospital expenses for the patient’s set of doctors with different specializations, intubation, laboratory tests, ventilator, respirator, and medication. It also varies from where the patient will get admitted. The treatment in private hospitals is relatively more expensive than government-owned hospitals and facilities.

Below is a chart that shows the possible coronavirus-related medical costs for each patient:

Our Expat client who was diagnosed with COVID-19 in Phuket, Thailand

Phuket is Thailand’s largest island and has been home to 115,000 expatriates from around the world. One of those is our client — a French national who was, unfortunately, a confirmed case of COVID-19.

Last March, he contracted the virus which cannot be treated through home quarantine. He was then admitted to Bangkok Phuket Hospital to undergo the necessary treatments. When he got discharged, his total medical expenses amounted to over THB 250,000 or approximately USD 8,000.

Our client survived this challenging time without having out-of-pocket expenses related to his COVID-19 treatment. Since 2017, he has been an EasyCare+ Plan holder which protected his savings even at the time of a pandemic.

COVID-19 coverage wherever you are around the world

The COVID-19 crisis affects people’s financial stability and most of all, their overall well–being. As an international healthcare provider, our goal is to provide our clients with continuous access to quality healthcare no matter where they are around the world and whenever they need it. Even more during this time of a global pandemic, their health is our utmost priority.

A+ International Health Plans covers COVID-19 treatment so long as you are in good health at the time of registration and with no pre-existing conditions. For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally. Each of our health plans is tailored to your specific needs. You can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

Health insurance is getting a lot of attention these days. With the rising cost of medical treatment, people have been purchasing healthcare plans for themselves and their families. It is a major investment to make because they can be of financial help in case of an emergency.

When getting a health insurance plan, a few things can affect one’s premiums — some are uncontrollable while others can be changed through lifestyle choices. The following are the top factors that companies consider when pricing out their policies:

1. AGE

Health insurance premiums vary per age. Whether getting a short-term or long-term policy, age plays the biggest role in how much medical support a policyholder will get. While medical exams have been getting stricter nowadays, age also determines if a person qualifies for health insurance coverage in the first place.

How much will your premium be? The younger you are, the lower the premium. This is because young people have lower chances of visiting the doctor and facing health issues. On the contrary, the older you are, the higher your premium will be. Elderly insured individuals may require more medical support due to developing chronic conditions.

2. BODY MASS INDEX (BMI)

Body Mass Index or BMI calculates your body fat based on your height and weight. Paying good attention to your BMI is a starting point to assess your health condition. If BMI is higher than normal, it can help you determine if you are at risk for some serious illnesses, like type 2 diabetes, heart-related problems, and some types of cancer.

When a person is underweight or overweight, he might need to prepare a little extra when shopping for medical insurance plans. The quote can even be twice as high for people with obesity. That is why having a healthy BMI will help you enjoy standard insurance rates because you have higher chances of living longer.

3. PRE-EXISTING MEDICAL CONDITIONS

A pre-existing condition can either be a medical illness, usually chronic or long-term, or injury before the start date of your new health plan coverage. The question is, can health insurance companies reject your application when you have a pre-existing condition?

Depending on the insurer’s General Condition and government regulation, the insurer may or may not accept your plan application. They can accept you into the plan, but they have the choice whether to cover your pre-existing condition or put your pre-existing condition in the exclusion list, although some conditions can be covered after completing certain waiting period Therefore, if the insurer cannot cover it, the policyholder will need to shoulder all the costs related to his pre-existing condition.

4. FAMILY MEDICAL HISTORY

Aside from your state of health, health insurance companies would also want to know your family’s medical history. When you are genetically susceptible to certain diseases such as cancer and heart problems, there is a chance that your insurance premium will go up. But in most cases, it does not happen.

Medical insurance companies generally ask this to have a better understanding of your overall health. This will also determine the eligibility and pricing of your policy. Having a clean record on family’s health background should not worry a person who is applying for medical insurance.

5. SMOKING OR TOBACCO USE

According to the Centers and Disease Control Prevention, smoking is the leading preventable cause of death in the United States — causing 480,000 deaths each year. Smoking increases health risks and impacts the cost of your medical coverage.

Generally, health insurance companies charge high premiums to smokers, tobacco users, and people who have used tobacco for the last 12 months. This is because they are considered high-risk insurance buyers as compared to non-smokers. In the worst-case scenario, a person who smokes 2-4 cigarette packets a day may be rejected for a medical insurance plan.

6. PROFESSION OR OCCUPATION

Your job has major implications for your medical insurance policy. A job that is considered high-risk has higher premiums because it jeopardizes the insured individual’s life. Sometimes, a person with risky activities can be disqualified for coverage at all. Some jobs with hazardous duties are miners, deep divers, firefighters, airline pilots, and those working in high-rise construction.

Why is a higher premium charged for certain occupations? A restaurant manager who does not travel for his job has low-risk factors as opposed to a cruise line worker who may experience dangerous sea-related calamities. Accident-related risks increase a person’s probability of facing critical injuries or earlier-than-normal death, therefore, you have to pay more.

7. LOCATION OF STAY

Healthcare costs differ in every country or state. So when purchasing for medical insurance, where you live could affect your policy. Certain geographical locations have high premium rates due to a lack of healthy food options, shared climate, and health issues.

In the marketplace, there are numerous affordable options where you can choose a local or international healthcare plan. With international plans, you do not have to worry about moving to a different country because you have the freedom to choose which area you would like to be covered.

International Healthcare That Is Tailored to Your Specific Needs

When shopping for a healthcare plan, anyone is looking for the best value. Knowing these factors can affect your policy, it is now much easier to assess how much cost you would need to shell out for your protection. That is why it is important to research about the medical insurance company or simply talk to an insurance broker to sort out which plan works out best for you and your budget.

If you are looking for affordable yet comprehensive international healthcare, EasyCare+ International Health Plans gives you world-class protection wherever you are. Each plan is tailored for your specific needs. For as low as $28/month, you can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>Bali is Indonesia’s all-time favorite beach destination. Aside from their own unique culture, tourists flock here because of its stunning volcanic mountains, famous rice paddies, long stretches of beaches, and coral reefs. Last 2019, there were 6.3 million tourists direct arrivals in Bali alone.

The best time to visit Bali is during the summer months of June, July, and August. These are the times when the weather is driest and most days are sunny. Many Westerners love this island because it is an ideal warm-weather getaway.

However, beautiful places like Bali are not always a paradise. There are some factors that should be on your radar and not overlooked.

- Earthquakes and tsunamis because of active volcanoes

- Pickpocketing and thievery, just like in any other tourist-centric countries

- Red-flagged beaches where there are dangerous riptides

- Extreme water sports activities that are risky for beginners

- Uncovered manholes or drains

Accidents can still happen even on vacations

Accidents of any kind can ruin someone’s perfectly planned vacation in a snap. It becomes much more difficult when you are in a foreign country because the place is unfamiliar and sometimes, the language could be the barrier.

To reduce the stress and inconvenience when an accident occurs during your out-of-the-country holiday, take these necessary steps:

- Call the local emergency number (e.g. 911) immediately if you can or notify someone about the accident.

- Seek medical care whether or not you are severely injured. Even if you feel okay, the physician may find injuries that could worsen the case if not properly treated.

- If you have a health insurance plan, contact them to help you prepare regarding your medical treatment especially if you are in a worse condition.

Our client’s serious accident while staying in Bali, Indonesia

What is supposed to be a perfect summer holiday in Bali turned out to be a nightmare for our client — it was last June 13, 2020, when his most unexpected experience happened.

He got a sudden accident which seriously harmed his brain, sternum, ribs, and liver. A major injury like this is considered life-threatening and should be treated as soon as possible. As part of the emergency procedure, he was admitted to Local Private Hospital and then confined in the High Dependence Unit. The hospital contacted our 24×7 emergency assistance hotline and our medical advisor made the necessary arrangements to process the admission and surgery.

Healthcare plans come in handy when you least expect it

Aside from stress and trauma, a critical medical situation like this can badly affect a person’s financial stability without a healthcare plan. Thankfully, our client has been an Easy Care+ policyholder since November 2018. All of the medical expenses incurred in this accident were 100% paid(1), therefore, there were no out-of-pocket and additional expenses made.

His Easy Care Plan includes an Accident Cover which took care of all the medical expenses(1) for his hospital admission and surgery procedure. It includes the doctor’s fees, hospital stays, use of operating and recovery rooms, medical treatment, internal prosthetic devices, lodging, and final expenses. For people who enjoy activity hobbies, jobs, or any team sport, getting an international healthcare plan should be an essential thing to consider.

Worldwide coverage for as low as $28/month

Staying sharp at all times and avoiding potential dangers are important to prevent bad things from happening. But sometimes, no matter how careful you are, unexpected mishaps can still take place and they are something we cannot control. When staying in and out of your home country, a comprehensive International Healthcare Plan is a must to secure yourself and your income.

A+ International Health Plans includes an Accident Cover which pays all the medical expenses due to an accident(1). For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally. Each of our health plans is tailored to your specific needs. You can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

(1) Maximum reimbursement amount up to the plan limit.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

In today’s fast-paced lifestyle and especially with the ongoing pandemic, a healthcare plan has become a necessity to safeguard your savings, protect your family, fight lifestyle diseases, and insure early to secure yourself when unforeseen health incidents take place.

With the rising cost of medical expenses and access to good medical facilities may be limited, locally or internationally, having an insurance policy can be extremely useful in any medical exigencies.

A healthcare plan is medical insurance coverage that generally pays for medical, surgical, prescription drugs, and sometimes dental expenses incurred by the insured. When the insured gets an illness or injury, he can reimburse the expenses or the healthcare provider will pay the care directly.

The importance of having a healthcare plan

Insuring yourself with a healthcare plan is the best way to protect you and your family from financial strain in the event of serious illness or accident. For example, a person who has no healthcare plan suddenly suffered a broken arm. The diagnosis and non-surgical treatment for this condition can cost up to $2,500 or more. And if it requires surgery, the cost can escalate to a minimum of $16,000.

If you have health insurance, you can:

- Avoid paying a large sum of medical expenses

- Get treated as soon as possible in case of accidents and emergencies

Visit your doctor to get the care you need to stay healthy and prevent serious illnesses - Have peace of mind knowing that you are protected if anything happens

Things to consider before getting one

Choosing the right plan for you can be confusing and complicated. With a lot of things to consider such as coverage and care, how do you make the right choice? Here are the major things you need to know:

- Know your coverage needs. The very first thing to keep in mind is how much each plan will pay to cover your medical expenses and what coverage you want, or you need. Is general ward or semi-private room hospital accommodation acceptable to you? Do you prefer to be treated locally or internationally especially in high cost with high expertise places like Hong Kong, USA or Canada? Think also of all the possible scenarios that can happen unexpectedly, like cancer, injury or an accident. While the coverage may seem high at first, you may be shocked at how quickly you will reach that limit if you were to face a critical health issue in the future.

- Consider Inpatient only or Inpatient + Outpatient cover. In your policy, there are two types of hospital care that it may cover: inpatient and outpatient care. Inpatient care is a medical service that requires admission into a hospital or medical facility such as treating a surgery, organ transplants, and staying in the ICU. Outpatient care does not require a prolonged stay at a facility, like scheduled health checkups or visits to clinics. Do you only need inpatient care or both? It’s important to know it in your plan.

- Consider out-of-pocket expenses. List down the things that you need to pay on your own because they are not covered by insurance. Your out-of-pocket expenses may include:

- Deductibles. Before your insurance starts to help pay for covered services, there is a certain amount of money you must spend beforehand and it’s called a deductible.

- Copayment. This is a fixed amount covered for a medical service. For example, you are required to pay $30 each time you visit your primary care doctor or specialist.

- Coinsurance. Check your insurance policy if it has a coinsurance amount. This out-of-pocket expense is typically 80/20. You might have to pay 20% while your insurance provider will cover the remaining 80%.

- Decide if it’s a local or international plan. The insurance plan that best suits you strongly depends on personal situation. Consider these things: your way of work, your current health, the quality of the local healthcare systems and hospitals, and your need to travel frequently or change the country of residence.

- Total your maximum costs against your budget. Now, add up all the costs you need to end up paying for each plan you’re interested in. This includes monthly premiums and out-of-pocket expenses. If you know that you are in poor health or want to make sure that you will not suffer from expensive medical costs due to an accident, you may opt to go with a plan that has higher premiums or more coverage.

- Get an expert advice to fine tune the policy that is right for you. When after all the research, computations and considerations but you still cannot decide or still confused which plan to get, it is always wise to get advice from any qualified partners or insurance brokers to help you customize the plan according to your needs and resources.

Why Choose an International Healthcare Plan?

In general, having an international healthcare plan is like having the best of both worlds. You get to enjoy high-quality medical coverage in your home country and at the same time, get protected wherever you are around the world. No matter what happens, world-class care is within reach.

An international healthcare coverage may sound expensive but it does not have to be. With A+ International Health Plans, you can have access to a network of 10,000 doctors, hospitals, and clinics in more than 150 countries. Each of our health plans is tailored to your specific needs. For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

Cambodia, also known as the Kingdom of Wonder, is a Southeast Asian country with a rich history and culture. Neighboring Thailand and Vietnam, it is a treasure trove of amazing Buddhist temples, amazing beaches, and paradise-like islands.

Since it is famous as a safe and backpacking route for travelers, this country welcomed 3.3 million tourists last 2019. According to a study, over 100,000 expatriates are currently residing here — solid proof that it is one of the best places in Asia to live in as an expatriate.

But even if Cambodia is a safe country to live in, it always pays to be prepared because there is no guarantee that bad things cannot happen. Accidents are inevitable and can still occur under any circumstance, no matter how careful a person is.

Accidents happen when you least expect it

When traveling or living in a foreign country, one must always expect that inconvenience and sudden incidents can take place, even at the least unexpected moment. The most common accidents abroad include:

- Slips, trips, and falls

- Sunburn and heatstroke

- Road accidents

- Food poisoning

- Sports and excursions

According to a report, Americans visit the doctor on average 68.2 million times a year to treat injuries. Without preparation and protection, one can experience financial strain due to sudden and expensive medical expenses abroad. Given this, an international health plan is strong security to save you from out-of-pocket, expensive medical costs like surgery and emergency fees.

Take a look at the experience of our client from Thailand who got injured while having a fun sport activity in Cambodia.

Our Thai client’s injury while staying in Phnom Penh, Cambodia

Last June 2020, we got a call from our 29-year-old client that he got injured while staying in Phnom Penh, Cambodia. He suffered a complete rupture of his Achilles tendon from a social badminton game, and the accident just involved himself. Because his home country is in Thailand, he requested evacuation and repatriation for medical treatment at Bumrungrad Hospital in Bangkok.

Our medical desk advised that the patient is fit to take the flight, however, the current hospital in Phnom Penh said that there is no need for repatriation. Fortunately, their hospital has two surgeons who can perform surgery as soon as possible. They are highly trained surgeons who are professionally accredited to treat the patient’s condition if he permits. The patient finally decided to perform the surgery in that hospital. The next day after, it was successfully done. He was advised to stay for a few days in Cambodia for recovery after being discharged from the hospital.

This unforeseen situation is the reason why he got an international health plan which includes an Accident Cover. If our client had not opted for this medical insurance, he would have paid all these accident-related expenses out of his wallet.

What is an Accident Cover?

An Accident Cover insures all the medical expenses in the event of an accident resulting in injury. It provides lump-sum cash benefits that are paid directly to the patient which may include the doctor’s fees, hospital stays, use of operating and recovery room, medical treatment, internal prosthetic devices, lodging, and final expenses.

Getting an Accident Cover which is supplemental to a healthcare plan can protect you and your family, especially people who enjoy risky activity hobbies, jobs, or any team sport.

Accident Coverage for you and your family worldwide

You cannot always prevent an accident, but you can be smart about how you will protect yourself in case that happens. Wherever you go, an international health plan is a wise investment to help you in case of emergencies and protect your savings from costly medical burdens. Beyond medical expenses, you can still enjoy financial stability and peace of mind.

A+ International Health Plans includes an Accident Cover which pays all the medical expenses due to an accident. For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally. Each of our health plans is tailored to your specific needs. You can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

For over five months, the COVID-19 outbreak has brought dramatic changes to people’s lives. Most countries face economic slowdown as unemployment, income losses, and financial hardships drastically arise. Many experience isolation, loneliness, and interruption of their normal routine. As physical distancing is imperative to slow down the spread of coronavirus, social activities such as hanging out with friends, fitness classes, sports, school, traveling, and many more have been postponed.

While people wish for everything to go back to normal, no one can tell how long this pandemic is going to last. With all these uncertainties and sudden shift in society, the coronavirus pandemic is taking a toll on everyone’s health.

Taking care of your physical health

Being stuck at home all day can lead to unhealthy lifestyle changes — more time sitting on the couch, increased alcohol or smoke intake, stress-eating, and no time for exercise. Letting these poor habits take over your normal routine can eventually sabotage your immune system and overall health. Here are some tips to keep your body in good shape while at home:

- Stay active. Regular physical activity is beneficial for both the mind and body. According to WHO, adults should do at least 150 minutes of moderate-intensity or at least 75 minutes of vigorous-intensity physical activity in a week. This improves bone and muscle strength, blood circulation, and reduces the risk of heart disease, stroke, type 2 diabetes, stroke, and cancer —all conditions that are more prone to COVID-19.

- Eat healthy. Good nutrition can help the body prevent, fight, and recover from infections. Eat home-cooked meals rather than unhealthy take outs. Choose fresh produce, like fruits and vegetables, to ensure that the body is getting the proper nutrients it needs for a stronger immune system. For daily intake, the WHO recommends eating 2 cups of fruit, 2.5 cups of vegetables, 180g of grains, and 160g of meat and beans.

- Sleep well. All the stress and worries brought by this pandemic can disrupt a person’s sleeping pattern. Some of the factors include disrupted daily schedule, the feeling of isolation, more time on screens, and even unpleasant dreams. Not getting enough quality sleep can affect your energy, focus, and ability to function during the day. There are ways to prevent this by minimizing naps during the day, setting a regular bedtime schedule, and having healthy daytime habits.

Taking care of your mental health

Feeling anxious and stressed is normal during the pandemic. To get through this tough situation, it is helpful to control what you see and limit the factors that can trigger such emotions. If you think the stress is getting out of hand, here are some ways to protect your mental health:

- Take a break from the news. While it is very important to stay updated on what is happening, it could also be draining. Follow only the trusted sources to avoid getting misinformation that leads to unnecessary stress. Limit the amount of time you spend on social media and set a specific schedule to check in with the news.

- Stay connected with family and friends. Social distancing is not a hindrance to connecting with people. Because long periods of isolation can make someone feel alone, communication is key to maintaining good mental health. A simple call or text with family and friends can go a long way.

- Avoid burnout. Keeping calm during a pandemic is already challenging. It even gets tougher when work and life at home need to be integrated. According to a recent survey, 54% of 1,000 employees feel more stressed about working from home. To avoid burnout, one must set realistic goals for the day and switch off at work at a designated time. This allows you to breathe, slow things down, and do the things that make you happy. Practicing daily meditation also can help relax and rejuvenate the mind and body.

- Explore new healthy habits. Doing the same old routine can make a person feel exhausted and unmotivated. Think of new ways how you can still be productive and feel excited while at home. Starting a new project such as gardening, yoga, and learning a new skill can keep you calm and steer in positive thoughts inside your mind.

Safety precautions in the new normal

As everyone walks their way to the new normal, it is important to focus more on prevention to stay safe. Without following precautionary measures, all spent weeks in isolation may eventually go to waste. So while the virus is still out there, following these simple actions can save your life and everyone around you.

- Masks. When leaving home, always wear a mask to protect yourself and others. A mask is two-way protection to keep us all from breathing each other’s air and from contracting any infectious germs and viruses. Avoid touching the mask while using it and dispose of immediately after use into a proper trash bin.

- Physical Distancing. Greeting someone, such as a handshake or hug, is a big NO in the new normal. Keeping one-meter distance is essential to slow the person-to-person transmission of coronavirus. As much as possible, just stay home and avoid crowded places where it is difficult to keep a distance from people. If you are feeling sick, practice self-isolation to limit contact with others.

- Washing hands and good hygiene. Handwashing plays a powerful role in fighting COVID-19, especially after returning from a public place, before eating food, and after coughing or sneezing. The physical action of scrubbing hands with soap washes the fragments of the virus away when you rinse. When soap and water are not available, an alcohol-based sanitizer containing at least 60% alcohol is the next best option.

Signs to watch out for if you need help

With COVID-19 concerns dominating our daily lives, it is important to know when this pandemic is creating a negative impact on your overall well-being.

Some of the signs include:

- Anxiety and depression

- Mood changes, such as ongoing irritability

- Sleeping less or too much

- Finding it hard to manage everyday life

- Extreme weight loss and changes in eating patterns

- Problems with memory, thinking, and concentration

If you think you are experiencing these circumstances recently, it is advised to get help and talk to your doctor as early as now.

Getting protection for you and your family wherever you go

Now more than ever, a healthcare plan is a great armor to protect you and your family from unexpected situations. As the COVID-19 pandemic sweeps across the globe, it also puts a spotlight on international healthcare. Getting worldwide coverage is even a greater investment to secure your savings and have peace of mind wherever you go.

A+ International Health Plans cover COVID-19 treatment so long as you are in good health and with no pre-existing conditions. For as low as $28/month, EasyCare+ gives you international protection, whether you plan to travel or if you want to get the best healthcare locally. Each of our health plans is tailored to your specific needs. You can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

What is Evacuation and Repatriation?

Medical evacuation, mostly known as medevac or medivac, is an emergency evacuation for a patient who needs to be transported to the most adequate medical facility. When the emergency treatment or medical procedure is not available in any medical facilities in current location, the patient will be transferred to a higher level of medical care either via land, sea, or air.

Medical repatriation is the process of transporting a person back to his country of citizenship for rehabilitation or recovery. This is common for people who experienced tragic trauma or injury and needed to be flown back to their home country.

Who needs it and when is it needed?

When in a foreign country, be it for work or leisure, peace of mind is a necessity. Emergency evacuation and repatriation are most suitable for expatriates, frequent or business travelers, and foreign workers who are in areas where access to medical facilities is limited. Companies that have employees working abroad are highly encouraged to also get them covered from unforeseen emergencies. Accidents cannot be foreseen, and emergency evacuation and repatriation ensure that you can get the best medical care and trip back home in case it happens.

In these cases, a standard health insurance is not enough for your protection. Even if you are perfectly healthy, accidents can happen anytime and in the most unexpected moment.

Whether moving abroad, traveling, or away for a business, a medical evacuation and repatriation coverage is a better way to prepare for any shortcoming no matter where you are around the world.

The fancy cost when you do not have coverage

Since its purpose is to get the patient proper care urgently, evacuation is often done by land or air transport. A helicopter or jet is normally the most expensive cost in any health emergency because it serves as a flying intensive-care unit with a medical team on board. According to Forbes, these services typically start at $25,000 and can exceed $250,000, depending upon your current country.

While for repatriation, the costs for flight tickets back home for recovery should also be considered.

Without this coverage, the last thing a person can wish is to encounter a medical emergency in a remote locale or foreign country and be burdened with immense transport costs and worse, without the help of skilled professionals nearby.

A+ International for your evacuation and repatriation needs

Emergency evacuation and repatriation are, unquestionably, expensive, and complicated. An international health plan is the best way to protect you and your family from unexpected financial stress and unthinkable situations, locally and internationally.

While this kind of pressing circumstance is rare and unexpected, it is better to be prepared beforehand than to risk most of your savings because of tremendous medical bills. Most importantly, emergency evacuation and repatriation can help you to get the right medical attention and save your life in an emergency.

A+ International Healthcare has partnered with the best Global Emergency and Evacuation providers in the industry to give our clients peace of mind wherever they go.

Our Medical Evacuation benefit will cover all the costs needed for your emergency evacuation to the closest and adequate healthcare facility through an ambulance or emergency airlift. And if you need to receive ongoing medical treatment back to your home country, we will arrange and cover the transport costs for you with our Medical Repatriation benefit.

Easy Care+ plans by A+ International Healthcare are comprehensive and affordable with no hidden costs, additional fees, or out-of-pocket expenses. For as low as $28/month, you can enjoy the comprehensive benefits plus Emergency evacuation and repatriation included.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com, or follow us on LinkedIn, Facebook, and Twitter for more updates.

]]>

Source: Our World In Data – Situation Update Worldwide

A Wake-Up Call

The COVID-19 pandemic becomes a wake-up call for all nations to reshape and rethink the ways in which they view the healthcare system as one of the basic human needs in this modern society. Since global pandemics can still happen in the future, this is the time to shed more light on local and international healthcare. Governments need to put more attention to better medical services, facilities, and families need to think of the right medical insurance needs.

The New Normal

Health has always been our greatest asset and investment. But in this critical time, it has even become a top priority. Basic hygiene is being taken seriously, self-isolation, wearing face mask and physical distancing is now part of the new normal.

Many businesses have embraced telecommuting and have placed measures for remote working environment. Some countries’ Border Control, like Thailand, have put a stricter policy on travelers and started to ask for a Certificate of Insurance cover from foreigners visiting their countries. Having a medical insurance whenever and wherever you go is not a privilege anymore but has become a necessity.

This new normal will have to stay for as long as there is no vaccine available for COVID-19 globally.

Choosing a Healthcare Plan

According to an analysis from Kaiser Family Foundation, nearly 27 million people in the U.S alone may have lost employer-sponsored insurance as unemployment skyrockets. With this current global pandemic, people need healthcare protection more than ever.

In this trying time where family’s financial capacity is taking a big hit, one must think wisely when choosing a health plan. It is important to understand and compare the coverage, the benefits and cost. A local or international healthcare plan are the options to choose depending on the need to travel or your current residency status.

International Healthcare Plan does not have to be Expensive

Now that we are facing a global health issue, a global protection is an advantage. A regular health insurance at home usually does not provide medical coverage while traveling outside your home country. No matter where you are, it is fundamental to get high-quality care to avoid unexpected medical expenses. An international healthcare plan may sound expensive, but it does not have to be.

Easy Care+ International Health Plans give you peace of mind when you travel or if you want to get the best healthcare locally. Each plan is tailored for your specific needs. For as low as $28/month, you can have access to a network of over 10,000 doctors, hospitals, and clinics in more than 150 countries.

Contact us to get in touch with our Brokers or Get a Quote now.

Since 2008, A+ International Healthcare has been providing best-in-class medical health plans around the world. To know more about our products and services, visit http://www.aplusii.com or follow us on LinkedIn, Facebook and Twitter for more updates.

]]>Benefits, wide coverage, and price are some of the factors to consider when choosing a health plan. What are the things you need? Is it only covered within your country? And above all, is it within your financial capability? And the most common reason why people step back is the cost and limited coverage. But does it have to be? Let us debunk that! There is an international health plan to help you stay protected wherever you go.

Introducing Easy Care+

Perfect for all young individuals and families, Easy Care+ grants you the world-class coverage at the best price. It covers the essential benefits, so you will not end up paying for the things you will not use. You are free to choose among the four comprehensive Easy Care+ health plans starting from $28/month. For full plan details, click here.

FREE CHOICE OF COVER

Take your Easy Care+ plan with you wherever you move. Get treated with high-quality care anywhere in the world and have the freedom to reduce your premium by limiting your coverage area. With Easy Care+, it is not only affordable. Our goal is to make our health plans efficient, transparent, and accessible to our clients.

FREE CHOICE OF DOCTORS

We have an extensive network of the best doctors and top-rated facilities globally. You are free to choose the healthcare professional and hospital that suits your medical needs. With Easy Care+, leave all the work to us because we want you to enjoy global peace of mind.

EMERGENCY EVACUATION

Our worldwide coverage is designed to provide the best-in-class medical assistance for you and your family not just locally. If your family member needs a certain medical specialist or if the emergency treatment you need is not available in your current location, we will organize your evacuation to the best and closest medical facility.

FREEDOM TO MOVE

Whenever and wherever you are, Easy Care+ provides you coverage even if you move to another continent, get married, change your occupation, or wish to add a beneficiary. So if you’re an expat, someone who travels frequently, or a person who wishes to live abroad, no need to worry about protection! We have the most accessible and comprehensive international health plans just for you.

FREE MEDICAL ADVICE

For us, healthcare support should be convenient and available when you needed it the most. A Plus International has partnered with Abi Health to provide our clients medical advice from real doctors around the world. You can subscribe to get free access to fast and reliable medical advice within your fingertips. It is available 24/7 via messaging app.

Contact us to get in touch with our Brokers or Get a Quote now.

Disclaimer: Information printed in this page is for marketing purposes only. Final plan details shall be based on the published benefits table, restriction and terms and conditions.]]>